A Parisien Perspective

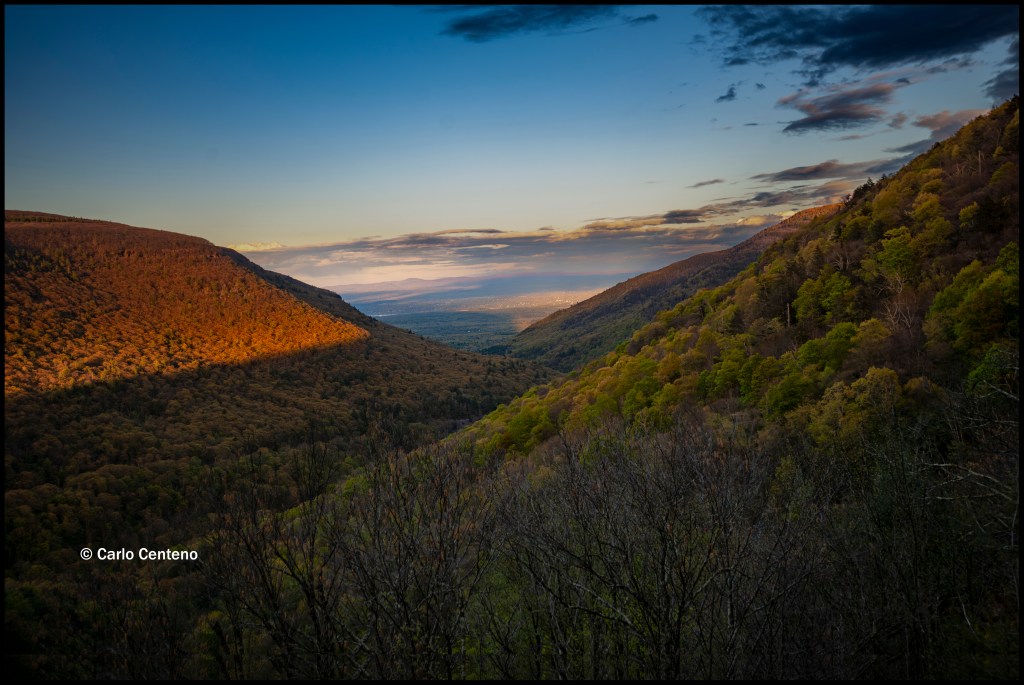

Keep an open mind. It matters when traveling to any destination that piques your curiosity. Whether it’s a neighboring state/province or an altogether different country, it requires elasticity in learning, appreciating and understanding. An open mind can open doors. It means possessing a willingness to be out of your comfort zone. And as you stand in your discomfort, your perspective may need adjustment or refinement. This is where you take the initiative to help others see your perspective. Naturally this requires staying attentive for the different position[s] you may encounter. It’s fine to disagree without being disagreeable.

Remind yourself that having an open mind tames the myopia that limits one’s ability to think beyond your horizon of possibility.

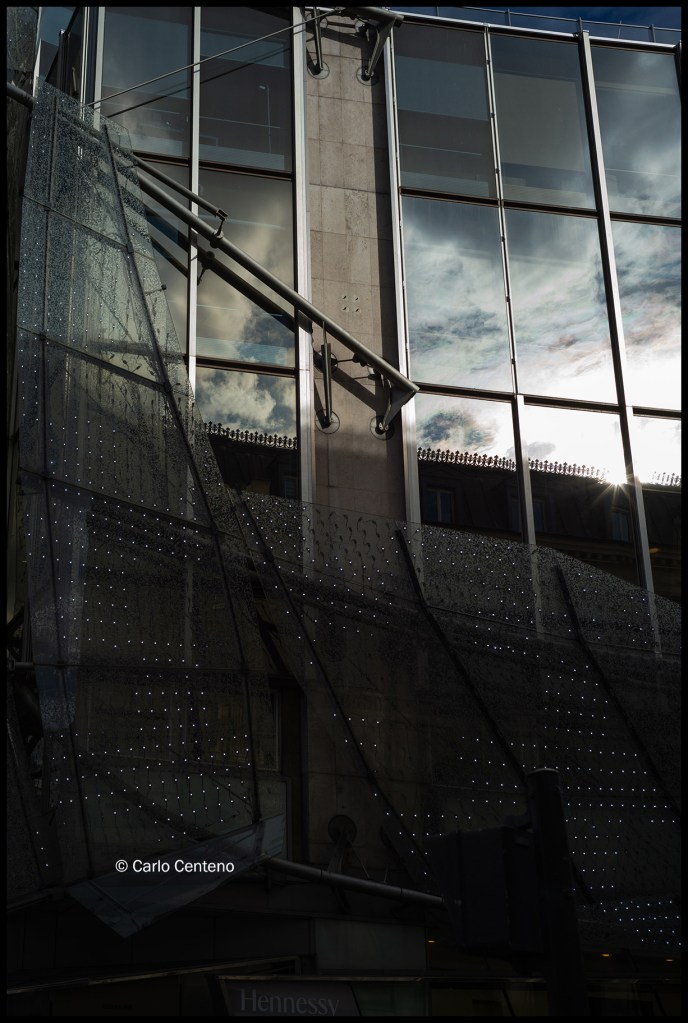

Eleven days in France this July made for quite a vacation. The coming of the summer Olympics turned Paris into a mixed bag of barricaded icons and walkways, detours and traffic. Our Parisian stay covered 3-days; not enough time to explore Paris, but 3 is better than none. A first visit to another city is as they say, an experience. Visually, aurally, olfactorily you cannot ignore the architecture, the gardens, the people, the language, the aroma of freshly baked croissants, baguettes and coffee and so on and so forth.

After Paris the next 8 days would be at Vignon-en-Quercy in southwest France. Fortunately, our flight back home was 7-days before the opening ceremonies, and we knew that more walkways and some open areas would be cordoned off. Predictably, logos and phrases proudly reminded of The Games coming to town. Still, nothing took away from our sense of discovery in this storied city.

We had thoughts of visiting the Louvre, Musee d’Orsay, among others, but the detours and limited access made it a physical and mental marathon. We were close to those museums and other points of interest as they say, but we unabashedly savored our quiet time in the Jardin des Tuileries, a garden between the Louvre and Place de Concorde. In a more relaxed pace, we enjoyed le Jardin and even took advantage of the cafes within the grounds. Seeing the Louvre from a different vantage point provided an unrushed appreciation for a 231 year old institution.

We thought of adding 2 more days in Paris. It would’ve certainly helped my french conversation, but other plans were already in place. Entering any business or eatery, saying bonjour is always helpful and polite. After the greeting, the most frequent words from my mouth were, Ou est…? or quelle direction est…? or pardonnez moi, sommes-nous pre du……? and of course, merci, bonne journee!

Our first morning, we walked to a bistro teeming with commuters and visitors. The menu on a sandwich board offered something we liked and I recognized: Petit déjeuner supreme ! Deux œufs [au choix] avec jamon et frommage, cafe, jus d’orange, baguette, croissant, confiture de fraises et salade. [Supreme breakfast! Two eggs any style with ham and cheese, coffee, orange juice, baguette, croissant, strawberry jam and salad].

We sat outside among a cluster of small tables and chairs, but the waiter advised we sit inside, though not far from the open frontage. Il y a trop de fumee dehors. Too much smoke outside as cigarettes are popular in most of France. It was a perfect time to watch people going on with their lives: scooters and bicycles carried a cast of characters; small french cars ruled the streets alongside taxis and Ubers, motorcycles and buses.

Based on our waiter, my french was so-so. Monsieur, I speak and understand english; you do not have to speak french…. Ouch. Polite but humbling. As he turned toward the kitchen order-window, I mumbled, C’est dommage….it’s a pity, too bad.

NEXT VISIT: a week in the town of Vignon-en-Quercy [….See you there.] !!!